The rates rebate scheme provides a subsidy to low income home owners and ratepayers on the cost of their rates. A rebate is required to be claimed during the rates year for which it is payable, therefore claims cannot be made for past years.

The first step is to establish that:

- you pay the rates on the address that you live at

- you were living there at the start of the rating year (1 July 2024)

- your name is on the rates bill.

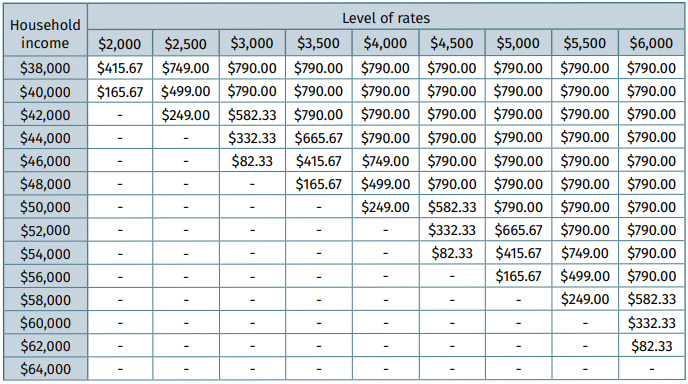

Once your eligibility has been confirmed, Council staff will assist you to complete the Rates Rebate Application Form and calculate your entitlement using the formula that considers:

- your gross income for the preceding tax year ending 31 March 2024

- the amount of rates you are required to pay

- the number of dependant people in your household.

You are able to check your eligibility for a rebate by:

- Visiting the Department of Internal Affairs Rates Rebate website. Enter your income, rates and number of dependants into the calculator to estimate your rebate entitlement.

- Contacting Council’s Customer Services Team on 0800 965 468.

Although this is a government scheme all claims are made to the council where you pay rates.

You may need to bring with you details of your gross income for the tax year ending 31 March 2023 including details of interest, dividends etc.

| Interest and dividends | Bank or company tax certificates |

| Any payment from WINZ (Work & Income) for the full year | No evidence needed for standard payments. Evidence of additional allowances eg. Accommodation allowance is required. |

| Payment from WINZ for part of the year only | Confirmation of amount received. IRD can provide this amount of any accommodation supplement received. |

| Employment | Gross income for tax year ending on 31 March 2024. Your employer or IRD can provide this. |

| Self-employment | Accounts for the tax year ending on 31 March 2024. Your accountant or tax agent can provide this. |

When to Apply

If you received a rebate in the previous year we will write to you near the end of June to advise the procedure for the next years’ rebates.

Rebates will be issued from July through to June the following year. You do not need to pay your rates on the day that you get your rebate.

For a more fixed date please contact the Customer Services staff on 0800 965 468 (0800 WMK GOV).

Where to Apply

The Council has service centres in Kaiapoi, Oxford and Rangiora. Please phone 0800 965 468 (0800 WMK GOV) to book an appointment.

A typical application will take around 15 minutes and confirmation of the outcome will be given at the end of the process. If you are self-employed or have overseas income, allow a bit longer.

Bring your latest rates assessment if you have received it, and details of your income for the year.

If the property is in the name of a Family Trust, you need to be named as a Trustee on the Certificate of Title, and have your name on the rates database. You also need to live at the property.

If you are self-employed or have overseas income please let us know when you book an appointment as it may take more time to process your application.

Phone Customer Services on 0800 965 468 (0800 WMK GOV) to discuss your circumstances.

Retirement village residents with licence to occupy agreements can apply for a rates rebate (Retirement village residents with licence to occupy do not own the property they live in but they do have a contractual right to occupy).

Being able to apply for a rebate does not guarantee you will received one. Eligibility is determined on your household income, rates (your village operator will provide rates details for you), and the number of dependants living with you.